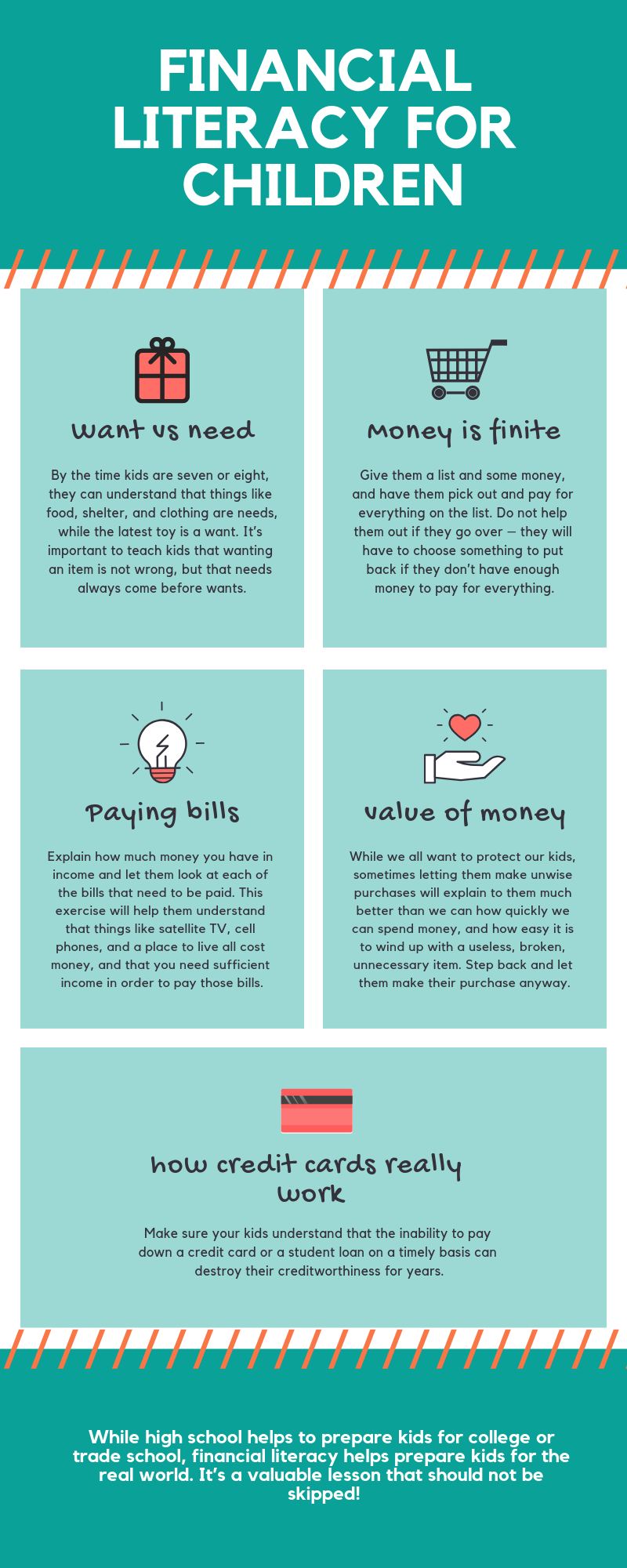

5 Things to Teach Your Kids About Finances

by Stacy Brasher on Nov 22, 2018

If you’ve spent more than five minutes on a kid’s television network, you’ve seen just how inundated young kids are with commercials for everything from the latest gadget, to some dreadful snack that features something gooey and/or messy. It’s also safe to bet that many of these kids run to their parents, wanting to buy some or all of these items.