The Power of "Meh"

by Stacy Brasher on Feb 28, 2019

I’m not unique in that, like many professionals privileged to lead, I wear many hats. Any given day, on top of serving clients, I may be connecting with our external partners, finding new ways to motivate our team, and generally directing and setting goals for the firm. Now, those duties are all pretty par for the course for someone like me in our industry, and I’m sure plenty of my peers in financial services could attest to the importance of staying on top of those responsibilities. But I think I speak for the whole Nowlin & Associates family when I say that we as financial services professionals also have a charge that is utterly unique in our field. It’s not explicitly in the job description for any of my colleagues, but it’s a demand that we all have to learn how to handle; we have to grow into a role as psychologists.

No one’s better at explaining how we have to adapt and grow our capacity for this particular part of client services than my good friend and associate Lee Williams. As a highly competitive professional golfer, Lee learned firsthand that pure athleticism and raw talent on their own weren’t necessarily the keys to finding success in his game. Rather, he’ll tell you that “In order to be successful I had to manage my expectations. You hear so often in sports how a lot of the battle is in your head.” I couldn’t agree more. Managing your own expectation of your performance is the critical foundation upon which winning strategies are built. Your own perception of the task or circumstances before you has a very real effect on your results and output when the rubber meets the road.

As a former collegiate athlete myself, Lee’s analysis hits close to home. What makes sports so exciting is that in any game played anywhere, it always feels like anything could happen. In my case, there was always a chance we could call a play on the football field that would take our opponents by surprise and give us a leg up. For Lee, a single stroke could mean the difference placing where he wanted among a field of players and a perceived “failure.” Storybook comebacks will be mounted. Top seeds will fall to underdogs. It happens every season in every league. And while we know that one party is ultimately going to win and another will ultimately lose, it’s the how of it all that keeps us coming back. And the meat of that how happens before an athlete ever steps onto the field of play–it happens psychologically when they set their expectations. This became clear to Lee thanks to his inside perspective as an athlete. Professionals with the means to do so often hire sports psychologists who help analyze and manage their expectations, improving their performance. Whether our clients realize it or not, we as financial services professionals have to step in and act as a psychologist of sorts for them. Managing expectations must be incorporated into the suite of services we render on a day-to-day basis.

The question then becomes how does expectation management theory translate from the fairway to the financial world? The easiest way to start is by rolling mindfulness of this responsibility into established workflows to augment and improve what you’re already doing for those you serve. Start with the bedrock of any good personal or professional relationship: communication. In his experience, Lee has noted that communication regarding expectations needs to be established on the front end of a client relationship. If a new client has unrealistic expectations of the returns they can expect from a particular strategy that aren’t addressed to begin with, then naturally they’ll be unhappy with the direction of our management. That’s one of a multitude of reasons why explicit goal setting is so important in our industry. You can ask any of my colleagues. If we set a goal together and don’t reach it, I won’t mince words. I will, however, redouble our efforts and reach for the next rung of the ladder.

Beyond this initial phase of goal setting at the outset of a new relationship, communication and expectation management have to continue for the long haul. The fact of the matter is that the economy is going to change. Your clients’ situations are going to change. A job can be lost, a disaster could strike, an elder could need emergency care, nothing is off the table. Any of it could happen overnight. On the more positive side of the unpredictability coin, a client could wake up one day and decide that its time to set the wheels in motion to prepare for the retirement phase of their wealth, or that the startup idea they’ve been mulling over for years is finally ripe and ready to realize. Whatever it may be, a change in direction calls for a change in overall expectations. Schedule a sit-down to reframe the future sooner rather than later.

All that said, while readjustments are always going to be necessary, the principal goal we look to achieve with effective psychological management of client expectations is to keep their thinking calm, comfortable and consistent. Our chief concern should be tempering their attitudes and emotions when those big shifts do occur, especially when external market forces beyond their control bring them about. Emotional decision-making is almost never good financial decision-making. Enter the power of “Meh.”

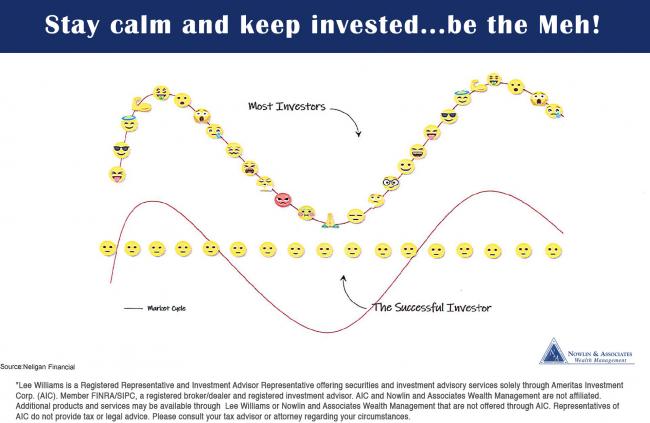

What exactly does it mean to be Meh, and why do my team and I work to persuade our clients to its virtues? I’ll refer you to the accompanying graph as well as back to Lee: “The bad investor has a million different mood swings throughout the investment cycle,” whereas the good investor “has a stable pulse attitude.” The “bad investor” in the graph Lee alludes to above represents the worst of what we’d colloquially call “knee-jerk” economics. Panicked rushes into and out of the market, as illustrated in the top graph, inevitably lead to patterns of buying high and selling low. You don’t exactly have to be Paul Krugman to understand that this is a losing strategy. It’s within this cycle of panic that we have to intercede as good stewards of our clients’ assets. As “psychologists,” we have to be able to analyze where their anxiety is coming from, how its impacting their money, and ideally push them closer to a mode of thinking that more closely resembles figure two above–the "Meh" curve, or more aptly, the "Meh" line.

Sometimes psychology will show you should not have all your eggs in one basket, i.e. the market (that's a blog for another day). However, if you do, one of the first things I learned in this business is that you never lose money until you sell. It’s a mantra that’s served me well to this day. Part of helping people understand the virtues of the “Meh” approach is changing their thinking with regard to the assets they’ve invested in. I do my best to communicate that they’re buying equity–a piece of the pie that will grow and shrink with time–not just the number on their stock ticker app. If you choose to invest in the market, the key is time spent in the market, not timing the market. More time means more opportunity for your piece of that pie to grow, and for wrinkles that crop up along the way to iron themselves out in the long run. Staying in, staying cool, and staying in touch are the hallmarks of the Meh investor. And there’s power in "Meh".

To wrap things up, I’ll throw it back to Lee: “I believe as an advisor my job is to help clients be more "Meh", which all starts with managing expectations.” When we communicate clearly, we put ourselves in the best position to set explicit, realistic, attainable goals. Always remember that “attainable” doesn’t preclude the ambitious. Once solid goals and expectations are set, it’s time to sit back and let Meh work its magic. Meh will help you make better, more rational decisions that are forward-thinking instead of married to the immediate here and now. Let’s move forward together and embrace everything that "Meh" can do.